PART 1 – Identifying the archetypes of women migrant domestic workers in Singapore

In December 2021, UNCDF published a working paper suggesting a new approach to designing digital remittances – one that is both gender-smart and migrant-centred. In this blog series, we explore the application of the first design principle presented in the paper – “Conduct customer and transaction research to understand migrants’ financial lives and how they are gendered” – with a focus on women foreign domestic workers in Singapore. We show how, through customer research, remittance service providers (RSPs) can identify archetypes modelled around customers’ remittance behaviours. We then explore how RSPs can leverage these archetypes to identify the value proposition for foreign domestic workers to choose and use digital remittances.

Picture Vinda – she comes from Balikpapan, a port city on the island of Borneo, in Indonesia. Unable to find a job after completing her bachelor’s degree, she recently accepted an opportunity to migrate to Singapore as a foreign domestic worker, leaving behind her parents and a younger sister.

Vinda hopes that through her employment in Singapore she can save enough money in a couple of years to fund her entrepreneurial dreams back in Indonesia. Although she has been with her employer for only five months, her experience has been mostly positive. She is paid on time through a bank account she opened when she first arrived in Singapore, and she opened a separate account for savings towards her migration goals. She gets two free days a month and she is allowed to use her mobile phone at night.

Vinda remits a fixed amount of her income to Indonesia every month. These remittances go towards supporting the living expenses of her parents and her younger sister. Vinda is most interested in using digital remittances as she prefers the convenience and would rather not spend her days off queueing to send money home. She has tried out several remittance providers but so far, she is dissatisfied with the services available to her, with limited opening hours during the week or closure on weekends, plus limited customer service support.

Vinda is digitally and financially literate. She owns a smartphone and uses apps for mobile top ups and making small purchases. She also relies on recommendations for financial services from her friends and from social media.

Vinda is not a real person. She is a composite persona based on insights from interviews conducted by UNCDF with over 60 foreign domestic workers in Singapore. Yet her story is very real and has implications for RSPs looking to tap into the market of around 250,000 foreign domestic workers in Singapore, the majority of whom are women, originating mostly from Indonesia (50%), Philippines (28%) and Myanmar (20%).

Vinda is not alone in her dissatisfaction with digital remittances. Based on the UNCDF’s analysis of more than 60 million transaction records from RSPs in sub-Saharan Africa and Asia, women make up only 10 to 25 percent of migrants sending remittances digitally¹. Women migrants report more challenges navigating the onboarding process compared with men.

Stories like Vinda’s are often lost when RSPs treat migrants as a homogenous group during the remittance product development process, despite the growing acknowledgement that remittances are gendered (Kunz and Maisenbacher, 2021). Thus, the gender gap in remittances persists, and is unlikely to close unless RSPs account for gender during the design process.

While personas can tell us a lot about who is a customer now, archetypes tell us a lot about the needs, wants and aspirations of a customer. Archetypes also focus directly on user behaviour and how the customer interacts with the product. Determining the archetype of a digital remittance product is grounded in a deep understanding of both the product and the end customer, which requires asking questions such as:

- What are the general characteristics of the customer?

- What is their goal of using the product?

- What is the customer focused on when using the product?

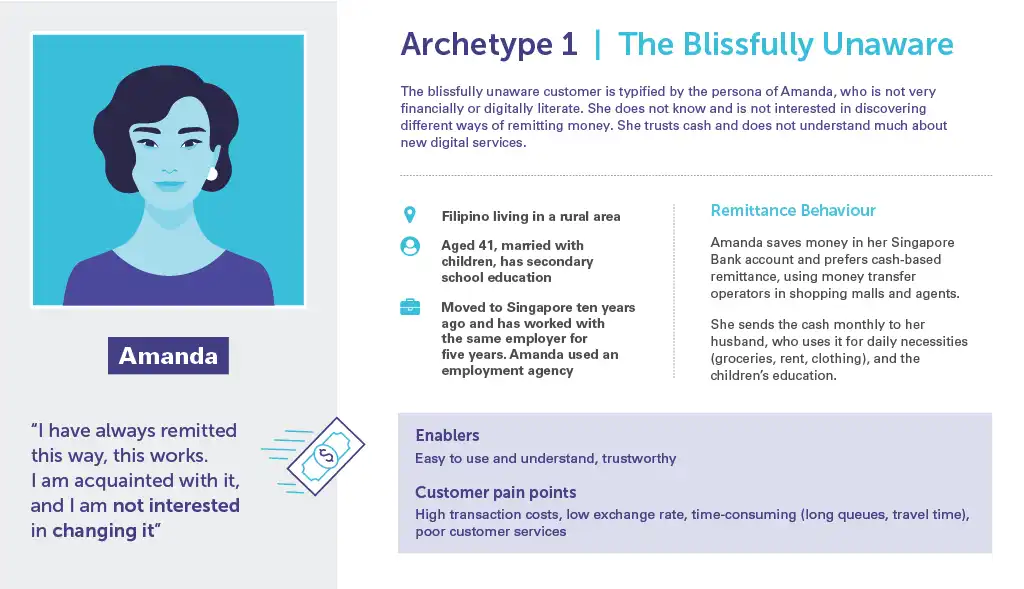

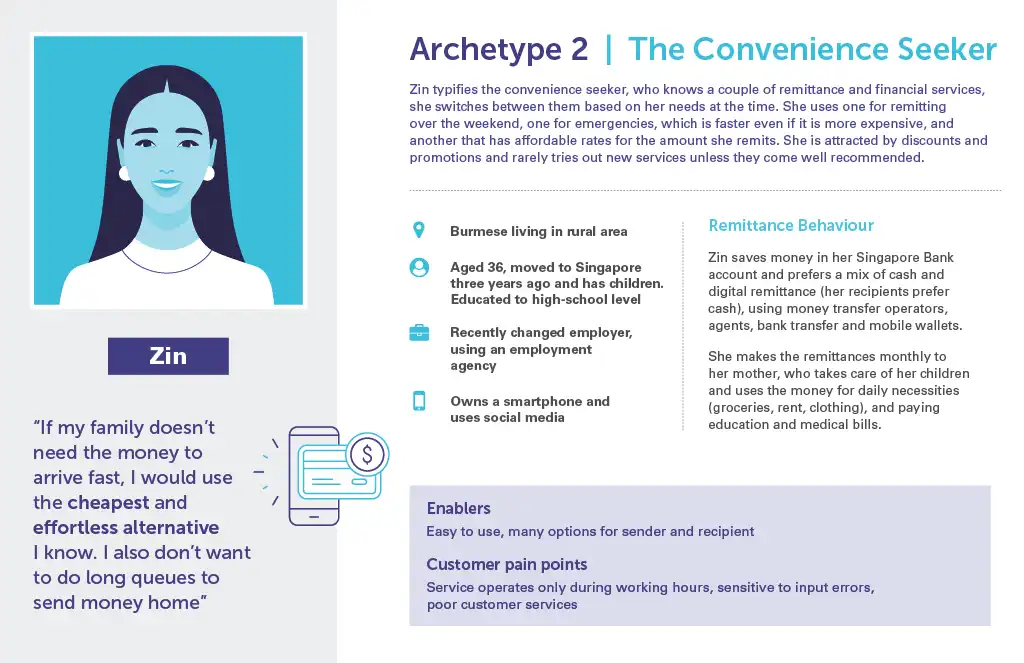

The digital explorer archetype linked to Vinda’s persona is one of three archetypes that UNCDF has developed to support RSPs to achieve a deeper understanding and more nuanced segmentation of foreign domestic workers in Singapore and other host countries. We have plotted these three archetypes, as follows, based on willingness to try new financial services and digital/financial literacy.

The customer archetypes highlight mostly the customer needs and behaviours regarding the choice and adherence to remittances and financial services. Once they have been identified, RSPs can leverage customer archetypes to shape the value proposition for digital remittances for this customer segment. Designing with the value proposition in mind, RSPs can better ensure product-to-market fit.

[1] Digital remittances are those that originate from digital channels such as mobile/digital wallets or bank accounts, or remittances that are received and terminated through a digital channel, or both. UNCDF considers digital remittances to be those both originating and terminating in a digital channel.