PART 2 – Leveraging customer archetypes to shape the value proposition of digital remittances for women foreign domestic workers

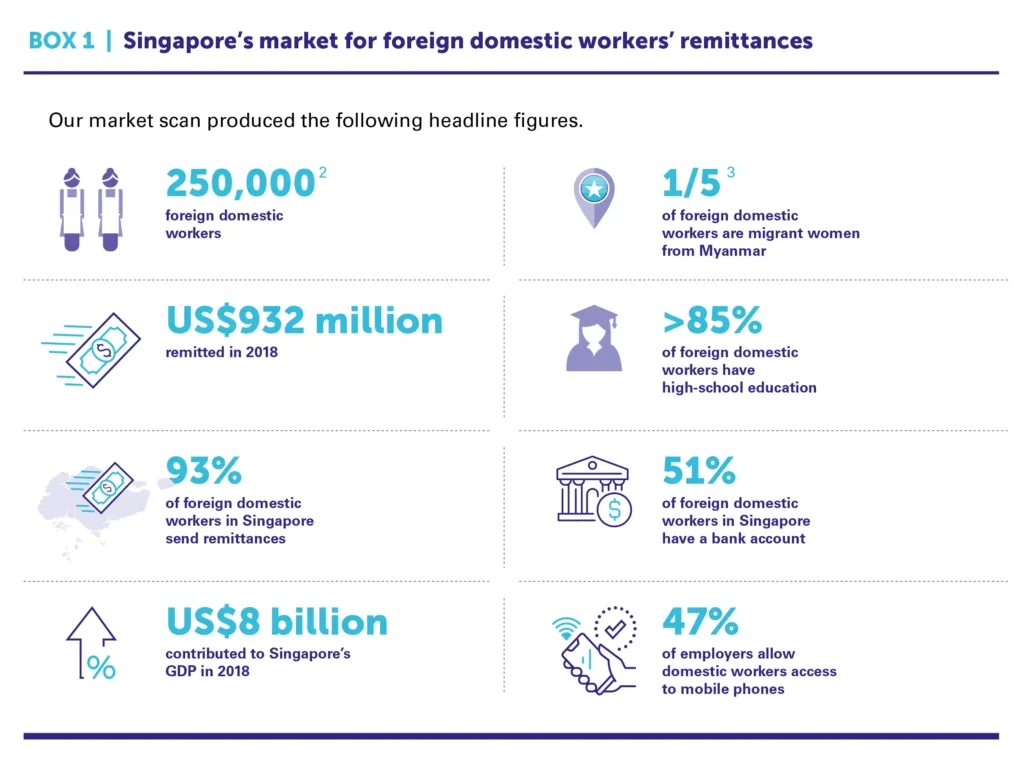

When working with remittance service providers (RSPs) to design gender-smart and migrant-centric digital remittances, UNCDF starts by supporting the RSP to better understand the target market and customers through research. Typically, this starts with conducting a detailed scan of the market to understand the business case for digital remittances. Market scans are a useful tool for gathering and synthesizing secondary data on customers in the selected market to gauge current levels of access and usage of digital remittances. They also provide some initial indication of the opportunities and challenges faced by customers. Box 1 summarizes the findings of the market scan of the Singapore remittances market, with a focus on foreign domestic workers.

The demand for foreign domestic workers will continue to grow in Singapore, according to projections from the International Labour Organization (ILO), due to an ageing population, lower fertility rates and women’s increasing labour force participation. On average, two-thirds of foreign domestic workers spend over two years working in Singapore before returning home, doing a range of duties that usually include cleaning, washing, ironing, shopping, taking care of children and older family members, and other household errands. Most foreign domestic workers live with their employers and, on average, earn S$500-S$800.

Most employers pay these workers in cash or send money directly to their bank accounts. The lack of formal financial services suited to the unique needs of foreign domestic workers constrains their ability to save and to access credit, exposing them to unexpected financial shocks. In addition, they have limited digital and financial literacy; for example, around 20 percent in Singapore did not know how to open or use a bank account. The high transfer cost of remittances leaves them with less money in their pockets. On top of that, foreign domestic workers withstand restrictive employment practices. A recent ILO and UN Women report showed that only 47 percent of employers surveyed allowed domestic workers access their mobile phones out of work hours, suggesting it is “common for employers to restrict domestic workers’ access either to phones or Wi-Fi”.

Following the market scan, UNCDF conducted qualitative research 4 in Singapore between October and December 2021, including interviewing over 60 foreign domestic workers from the Philippines, Indonesia and Myanmar to refine the customer personas emerging from the market scan and to identify the linked archetypes. Once the archetypes had been identified, the final step in the research process was to map their customer journeys. This identifies the pain points faced by each foreign domestic worker archetype in Singapore when remitting digitally.

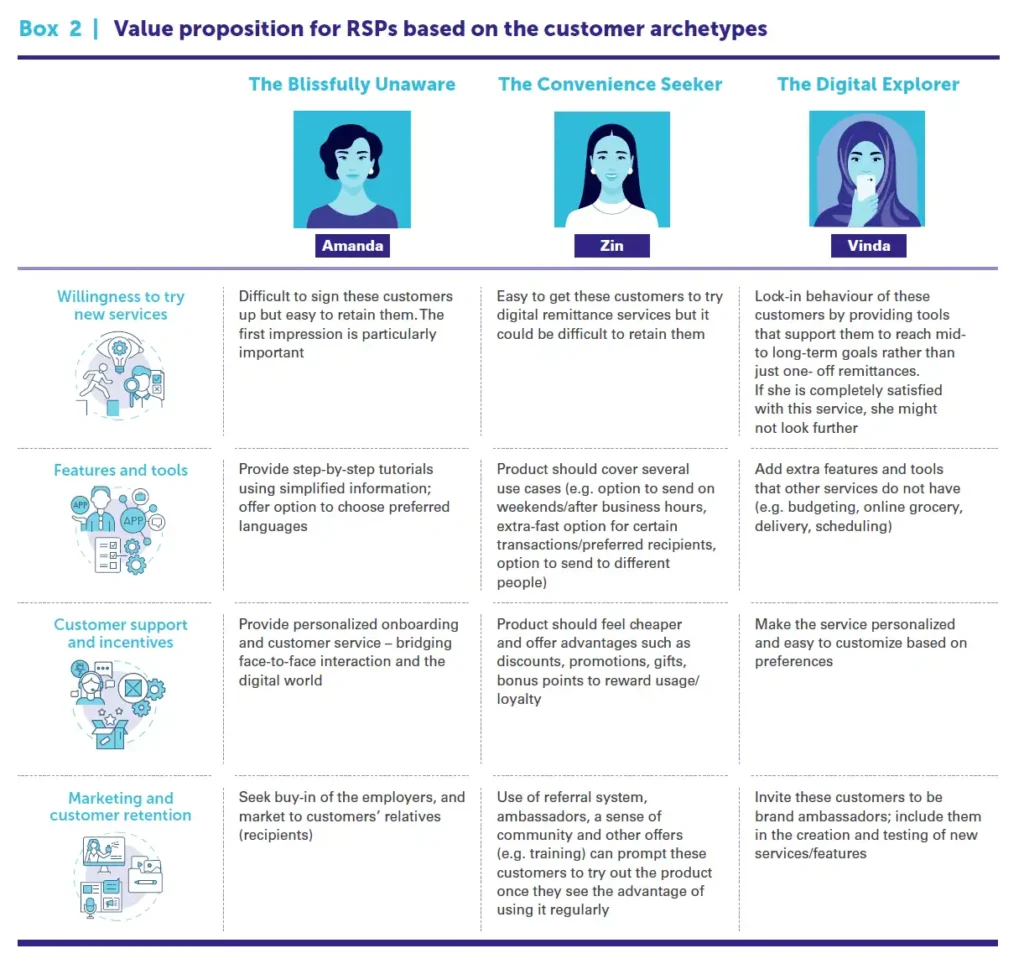

By identifying the customer archetypes and mapping the customer journeys of foreign domestic workers, RSPs in Singapore can better understand the potential value proposition for digital remittances through four key points:

- Determine the willingness of foreign domestic workers to access and use digital remittances based on an understanding of customers’ characteristics and behaviours.

- Determine which features and tools to prioritize based on an understanding of what customers value.

- Pinpoint where and when to provide support to customers during and after the onboarding process, based on an understanding of customers’ digital and financial literacy skills.

- Tailor their marketing content and channels appropriately, based on an understanding of where customers get their information from.

The low uptake of digital remittances, particularly among women migrants, could be linked to the growing disconnect between the products available to migrants and their real needs and behaviours as customers.

Identifying archetypes that account for customers’ behaviours and aspirations is a crucial first step towards understanding the financial lives of migrants and how these are gendered. It allows RSPs to shape unique value propositions for their customers to choose and use digital remittances.

By mapping the customer journeys of archetypes, RSPs can identify the pain points different customer segments are most likely to encounter when accessing and using digital remittances. They can thus tailor their product – including its features, tools, marketing and redress mechanisms – to ease these identified pain points.

By leveraging archetypes to inform the design process, RSPs would be taking a step towards designing more gender-smart and migrant-centred digital remittances that match the needs, wants and aspirations of customers.

[2] https://www.mom.gov.sg/documents-and-publications/foreign-workforce-numbers

[4] Research limitation: research was conducted with a limited number of representatives from the target population. While this allowed for greater depth to develop the customer profiles, it should be noted that the participants do not fully represent the diversity of experiences by the target populations.