The IGAD remittance landscape

In 2020, due to the COVID-19 pandemic remittance flows to sub-Saharan Africa fell to US$42 billion, from $48 billion in 2019 – but inflows to the IGAD region1 increased by 27 percent, to $8.1 billion. Inflows to the IGAD region account for 20 percent of the remittances received in sub-Saharan Africa – an average of 3 percent of the gross domestic product (GDP) of the region. If we include remittance flows through informal channels, the true size may be even larger.

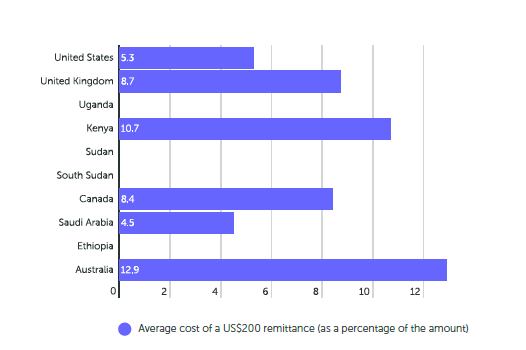

In 2020, the average transaction cost for a remittance of $200 to the region was 8.5 percent, while intra-regional remittance costs averaged 10.7 percent, more than triple the Sustainable Development Goal (SDG)’s target global average of below 3 percent.

The clearest way to illustrate the true cost of sending money is by looking more closely at these statistics. In 2020, remittances sent to the IGAD countries incurred average costs of just over $691 million, while intra-regional remittance costs were even higher, at $870 million.

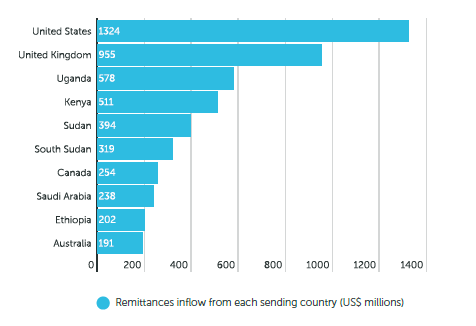

Remittance flows originate from both within and outside the IGAD region. Intra-IGAD remittance flows tend to occur between neighbouring countries. The direction of extra-IGAD remittance flows tends to be from countries in North America, United Kingdom and the Middle East.

Whether remittances flow from outside or within IGAD, all countries would benefit from regional collaboration on remittance flows, corridors, mechanisms, institutions and policy, especially given the COVID-19-driven impetus towards greater digitization. With the IGAD region already challenged by natural disasters and conflicts, COVID-19 brought additional pressures including economic slowdowns, unemployment, debt pressures and more.

The economies of destination countries within IGAD and outside IGAD were affected by the economic slowdown. This immediately impacted migrants’ ability to earn and send money and, in the medium term, may result in reduced employment prospects, forcing some migrants to return home.

A reduction in remittances will impact receiving communities within IGAD at a micro level (i.e., education, health, food dependencies), and will likely create larger economic impacts in terms of investments in small businesses, small and larger scaled trade flows, and impacts on inflows of foreign exchange and currency appreciation.

Many remittance transfers within the IGAD region are informal. In some remittance corridors, no formal remittance data are reported despite the presence of migrants. The hawala system, whereby money is paid to an agent in the origin country who then instructs an associate in the destination country to pay the money to the recipient, is common in the region.

Top 10 remittance-sending country (US$ millions)

Why are remittances expensive?

The high cost of remittances is caused by factors including limited operating hours and settlement delays due to reliance on an intricate network of correspondent banks working across different time zones and currencies. Disproportionate and disjointed laws and regulations from one country to another increase compliance costs, while the regulatory frameworks guiding remittance services have diverse requirements, making it difficult to establish cross-border remittance businesses. There are no standardized and transparent criteria for licensing international remittance service providers, including mobile money operators, or for securing approval to connect new corridors. Costs also arise from anti-money laundering/combatting the financing of terrorism (AML/CFT) checks.

Another bottleneck is the limited capacity of regulators to collect, monitor and analyse remittance flows at the transaction level, to inform timely and relevant decision-making. Data on remittances vary from country to country due to differences in the national legislations, methodologies, concepts used and availability particularly of sex-disaggregated data. While IGAD countries recognize the importance of standardization of concepts and definitions and of following internationally accepted guidelines and good practices in capturing and measuring remittance flows, there are different levels of implementation. For example, balance of payments and remittance statistics are compiled in accordance with the standards set in the fourth and the fifth editions of the IMF’s Balance of Payments and International Investment Position Manual.

Lack of availability of digital remittance channels, coupled with the lack of common standards for payment technologies, procedures and security features of payment infrastructures, means that similar innovations are not often compatible, even within countries. This creates processing costs and delays for the recipient, and often, women are more disproportionately affected.

Average cost of a US$200 remittance (as a percentage of the amount)

Opportunities for harmonization

To overcome cross-border remittance barriers and advance digitalization of remittances, regional cooperation is vital. The combined value at regional level will be much greater than the sum of the individual countries.

Designing gender-responsive policies to promote common interests and address common challenges, for ease of adoption and implementation at both regional and country levels, is crucial. Harmonization of policies can propel the development of legal and regulatory frameworks for remittance markets, ultimately benefitting the vulnerable populations, including women, while promoting trade and enterprise.

Regional harmonization of policies taking into account gender dimensions will increase provision of remittance services and the proliferation of new technology as cross-border financial entities transfer know-how to other countries. The benefits of scale associated with harmonization avails a broader range of formal financial services and products suitable for a more underserved diversified clientele, including women and men migrants, low-income workers and most of the rural population and women. Small market players can benefit most from regional harmonization, as it reduces investment costs and opens new markets for them which in turn allow them to build viable business models.

Tapping into the opportunities

For countries to participate and agree on standards and rules, there must be a sense of regulatory convergence. Implementing policy, legal and regulatory reforms and improvement of payment infrastructure, coupled with strengthening capacity, could reduce costs to a level that even a person on a very low income would be able to participate in the regional economy.

UNCDF, in collaboration with the Secretariat of the IGAD, is taking stock of regulatory and infrastructure arrangements in individual member states and critically reviewing them with a view to harmonize, with the goal of achieving regulatory certainty at domestic and regional levels and reducing the cost of compliance.

To address the challenge of the various approaches to remittances regulation, understanding the current remittances markets and regulatory landscape is needed – to capture ‘what worked’, ‘what didn’t work’ and what actions can be prioritized. One vital task is to identify enablers to regional harmonization, such as proportionate and non-discriminatory licensing procedures.

Challenges and frictions in cross-border payments

Digging deeper into licensing and authorization regimes to identify areas for possible convergence is also critical. This includes working with IGAD to establish a regional mutual recognition policy to promote remittance services. Under this policy, a remittance service provider licensed by the supervisory authority in one partner state can be allowed to operate in all partner states.

Improving financial integrity is an important enabler in promoting remittance service flows within the region. The AML/CFT laws and regulations could be improved by making them risk-based and proportionate based on the value of cross-border transactions. Risk-based due diligence should ease detection of suspicious transactions while allowing the regulator to focus resources where the risks are the highest. One regulatory response with a direct impact on account registrations could be the introduction of flexible Know Your Customer (KYC), e-KYC and on-boarding practices. This was shown in West Africa, where regulatory authorities permitted more flexible KYC processes during the COVID-19 pandemic, allowing more people, particularly women who are less likely to meet traditional KYC requirements than men, to make digital payments and avoid handling of cash.

Increasing remittance access through mobile phones would be the quickest way to offer the largest number of people cheaper remittance payment options, which would in turn facilitate the use of retail payment systems such as mobile money. According to World Bank data, in quarter four of 2020 the cheapest method for funding a remittance transaction was mobile money, at around 4 percent, compared with using a debit or credit card was at almost 5 percent and sending money using cash, at 7 percent.

Achieving cross-border interoperability and harmonization of payment infrastructures should permit high rates of automated ‘straight-through processing’ of remittances and ultimately allow automated reconciliation. Ideally, a system could be created where multiple central banks are directly connected or are able to interact instantaneously on a single network, to enable real-time settlement of cross-border payments. This could help to link national economies and drastically reduce the cost of cross-border payments. For example, in April 2021, the Monetary Authority of Singapore and the Bank of Thailand launched the linkage of Singapore’s PayNow and Thailand’s PromptPay real-time retail payment systems. Using just a mobile number, customers of participating banks in Singapore and Thailand will be able to transfer funds of up to 1,000 Singapore dollars daily between the two countries, for a fee of just S$3 for every S$100.

Last but not least, designing remittance-linked and attractive financial products for women and men migrants and their families, to encourage them to use regulated remittance channels can further help keeping remittances flowing in the region

Challenges in harmonization – and the way forward

Financial markets in the IGAD are at varying levels of development. This presents a challenge to setting up convergence criteria and interoperability is likely to be costly. If the costs of recommended solutions are too great, IGAD countries might fail to harmonize their remittance policies. The ongoing challenges of the COVID-19 pandemic and the associated decline of remittance flows further highlights the need for heavy investment in digital infrastructures.

Achieving harmonization requires sustained effort. To make harmonization a reality, it is important for each country to realize that it has a role to play and a responsibility to ‘give and take’.

Any lack of commitment could be addressed by involving private sector stakeholders, since the commercial benefits of the reforms would help to attain sustainability. Usually, private service providers place demands on the regulators regarding the need to modernize and integrate the payment infrastructure. Some of them initiate investments to upgrade their infrastructure in anticipation. Finally, capacity building for the relevant regulatory bodies is critical. This involves knowledge sharing, peer exchange, and development of skills and leadership.