Key insights

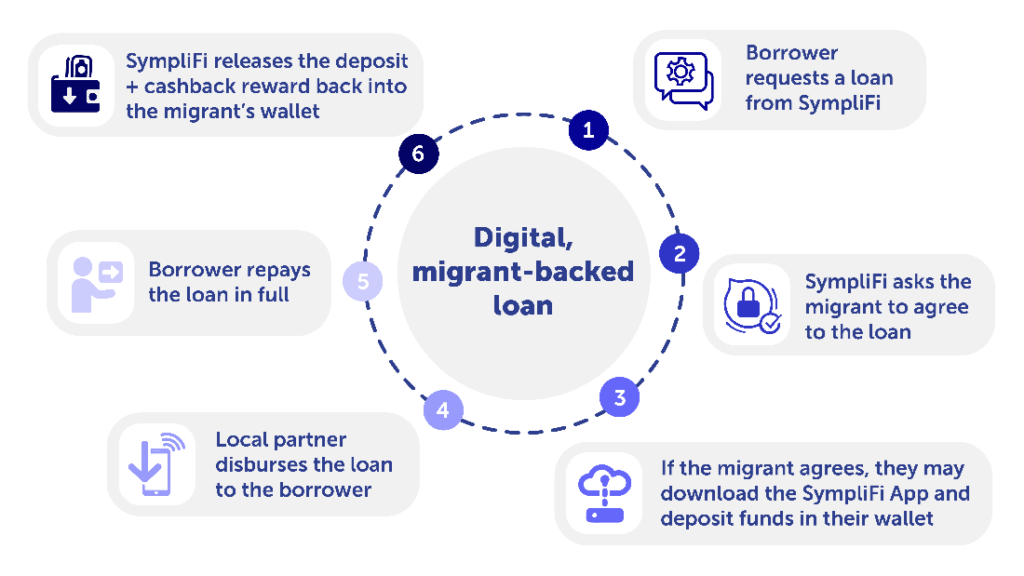

- The digital migrant-backed loan by SympliFi enables migrants to make refundable deposits that guarantee microfinance/small business loans for friends and family members (often unbanked) in their countries of origin.

- Having already established a proof-of-concept in the UK-Nigeria corridor, SympliFi sought the support of UNCDF to pilot the solution along the EU-Senegal corridor.

- SympliFi learned from the EU-Senegal corridor pilot that, to increase uptake, it must invest in raising consumer awareness among migrants and their families, adapting the product to be easy to use and meet customer needs, and responding to local financial institution partners’ concerns about perceived credit risk as well as the regulatory framework guiding the cross-country collateralized lending system.

About SympliFi

Remittance flows to Sub-Saharan Africa reached US$50 billion in 2021.[1] Most remittances are costly to send, cashed out, and are spent on everyday consumer needs. How can we ensure that remittances work as an on-ramp for wider financial inclusion for migrant families in developing countries, especially in Africa, where many struggle to access credit at reasonable rates?[2]

SimpliFi Financial Solutions Limited, using the commercial brand SympliFi, is a start-up company registered in the United Kingdom (UK). In 2020, SympliFi launched a digital migrant-backed loan product that enables Nigerian migrants in the UK to guarantee loans accessed by their friends and family members in Nigeria. With support from the United Nations Capital Development Fund (UNCDF), SympliFi planned to expand its operations to corridors from the European Union (EU) to French-speaking, Sub-Saharan Africa, beginning with a pilot in the EU-Senegal corridor.

The Digital Migrant-Collateral Solution

The digital migrant-backed loan uses refundable deposits made by migrants living abroad to guarantee loans for friends and family members (often unbanked) in their country of origin. Firstly, borrowers in the country of origin initiate the loan process by submitting a loan request of up to XOF500,000 ($800) on SympliFi’s website, most likely after seeing a digital advertisement on a social media platform. The request includes information about the guarantor, a migrant living in the EU or UK. Secondly, SympliFi sends a text message (SMS) to the migrant’s phone inviting them to guarantee the loan by downloading the SympliFi app (if the migrant isn’t already a SympliFi customer) and depositing the funds for the loan. The loan request and guarantee are then communicated to SympliFi’s local financial institution partner. Finally, the local financial institution partner contacts the borrower and invites them to open an account (if the borrower isn’t an existing customer), conducts the loan due diligence process, and eventually disburses the loan. When the borrower fully repays the loan, the deposit and a cash-back reward are returned to the migrant. The migrant may also guarantee another loan or withdraw their money from the SympliFi wallet. The customer journey is entirely digital for the migrant and partially manual for the borrower, depending on the local financial institution partner’s processes.

The main advantage of the digital migrant-backed loan is its potential to expand access to credit for migrants and their relatives in countries with limited access to credit for micro and small enterprises. The product also enables first-time borrowers to build a credit history, obtain additional loans, and gain financial independence. Furthermore, it may relieve financial pressure on migrants and enable them to send remittances at more convenient times and terms for non-business uses.

Lessons from the EU-Senegal Pilot

UNCDF and SympliFi piloted the digital migrant-backed loan along the EU-Senegal corridor from December 2021 to September 2022. During this time, nearly 5,000 Senegalese borrowers initiated loan requests, with more than half of them containing errors, primarily in the guarantors’ phone numbers. About 2,000 requests were subsequently processed by SympliFi, with an average loan amount of $450. Most of the migrant guarantors identified in the requests resided in France (51 percent), Italy (24 percent), or Spain (17 percent). However, successful loan disbursement rate was low owing to poor responses and a high decline rate by migrants to guarantee the loans.[3]

Qualitative research with migrants found that while they were prepared to guarantee a loan for family members through SympliFi, it was important to them to build trust in the product and for the guarantee to have flexible terms. Anecdotal evidence from loans disbursed during the pilot suggests that Senegalese SympliFi borrowers are self-employed entrepreneurs buying equipment, such as sewing machines, or input material to start or expand their businesses such as poultry.

Further research on the purpose of the requested loans and borrowers’ satisfaction with the credit terms would be helpful to better understand the needs, incentives, social norms, and behaviours of migrants and their families. This would ultimately inform Senegalese policymakers and development partners on sectors, segments, and business credit needs and help them implement the national financial inclusion strategy.

Throughout the pilot, SympliFi learned that to increase uptake, it must increase awareness among migrants and their families in their countries of origin, adapt the product to customer needs, and address the concerns of local financial institution partners about the credit risk and the regulatory framework for the cross-country collateralized lending transaction system.

Actions include the following:

- Product Design and Customer Journey: SympliFi has adjusted its loan product so that guarantors can choose how much they wish to put down as a refundable deposit, providing them with more freedom. Furthermore, SympliFi has given guarantors more frequent cash-back rewards to make up for any lost earnings from the amount they deposited. The customer journey has also changed to make it easier for the borrower and the guarantor to share information, which is achieved by giving the borrower a WhatsApp button that tells them to share the loan request information with the guarantor before SympliFi notifies them. Still, the throughput time has remained a challenge, mainly due to the local MFI partner’s loan due diligence and disbursement processes.

- Regulatory Clarity: SympliFi’s product faced challenges from the regulatory frameworks because it would hold deposits in sending countries (EU, UK) and then use those deposits as a loan guarantee in receiving countries (e.g., Senegal). Since SympliFi is not a bank, it partners with regulated banks in the destination countries to hold the migrants’ deposits and in the countries of origin to disburse credit to borrowers. Local banks were concerned whether the central bank authorized them to use the offshore SympliFi cash collateral to disburse loans. Furthermore, even if they were authorized, it was unclear from the regulatory framework whether they should set aside any capital for loan losses even though SympliFi held 100 percent cash collateral for the loans. With the help of UNCDF, SympliFi engaged with the BCEAO and got clarification for its product, to be considered as a foreign corporate guarantee under BCEAO regulations [4]

- Addressing perceived Credit Risk: The collateral by migrants has not resulted in reduced interest rates for borrowers, primarily because the risk associated with loans has not fundamentally changed at the partner’s end. Firstly, the cost of capital doesn’t go down because SympliFi loans are not eligible for lower capital provisioning under the BCEAO regulations. Secondly, SympliFi’s collateral comes with counterparty risks as SympliFi is a foreign company, not subject to any supervision by the central bank BCEAO. SympliFi responded to this risk by setting up legal arrangements to safeguard the amounts deposited by migrants.[5] Finally, the partner’s loan due diligence process does not grant prospective SympliFi borrowers any special status in order to avoid increasing non-performing loans, which would be a breach of the regulations.

- Marketing and Communications: The digital migrant-backed loan is a relatively new concept[6] still gaining traction among borrowers, guarantors, and other stakeholders. SympliFi has been increasing brand awareness gradually among stakeholders by developing partnerships with migrant diaspora communities in France, Senegalese social media influencers, and sponsoring diaspora-related events. However, the effectiveness of these communication campaigns has been limited in terms of loan application and disbursement rates. Financial institutions and fintechs must find more effective ways to market these products to customers moving forward.

Conclusion

Although participation in the pilot was limited, we learned important lessons and identified areas for further research to validate the business model, such as migrants’ willingness to use loans and guarantees instead of traditional remittances to support their family members. SympliFi will continue to improve its services, build more partnerships, and monitor the traction and sustainability of the business model. At the same time, SympliFi will explore other business models that are not borrower-led and do not rely solely on a one-on-one borrower-guarantor match but instead use a pool of migrants and investor funds to support locally sourced projects by specialized partner institutions such as accelerators or job-matching platforms.

References

[1] Ratha, Dilip and others, 2022. Migration and Development Brief 37: Remittances Brave Global Headwinds. Special Focus: Climate Migration. KNOMAD-World Bank, Washington, DC. License: Creative Commons Attribution CC BY 3.0 IGO.

[2] Napier, Mark, 2018. Giving credit to Africa’s financial markets and why we need to step up reform. Brookings. Available at: https://www.brookings.edu/blog/africa-in-focus/2018/08/01/giving-credit-to-africas-financial-markets-and-why-we-need-to-step-up-reform/

[3] UNCDF is not publishing the actual loan disbursement number to retain SympliFi’s business anonymity.

[4] Under the tri-partite agreement, local financial institutions are owners of the migrants’ deposits covering their disbursed loans even in the event of SympliFi’s default.

[5] A similar innovation has been piloted by OECD and UNCDF in 2021 in the corridor UAE to Nepal, using migrants’ financial behaviour data and without requiring migrants to deposit funds as collateral.

[6] OECD, (2021). The development potential of remittances using blockchain technology in Nepal, OECD Blockchain Policy Series. Available at: https://www.oecd.org/countries/nepal/The-development-potential-of-remittances-using-blockchain-technology-in-Nepal.pdf