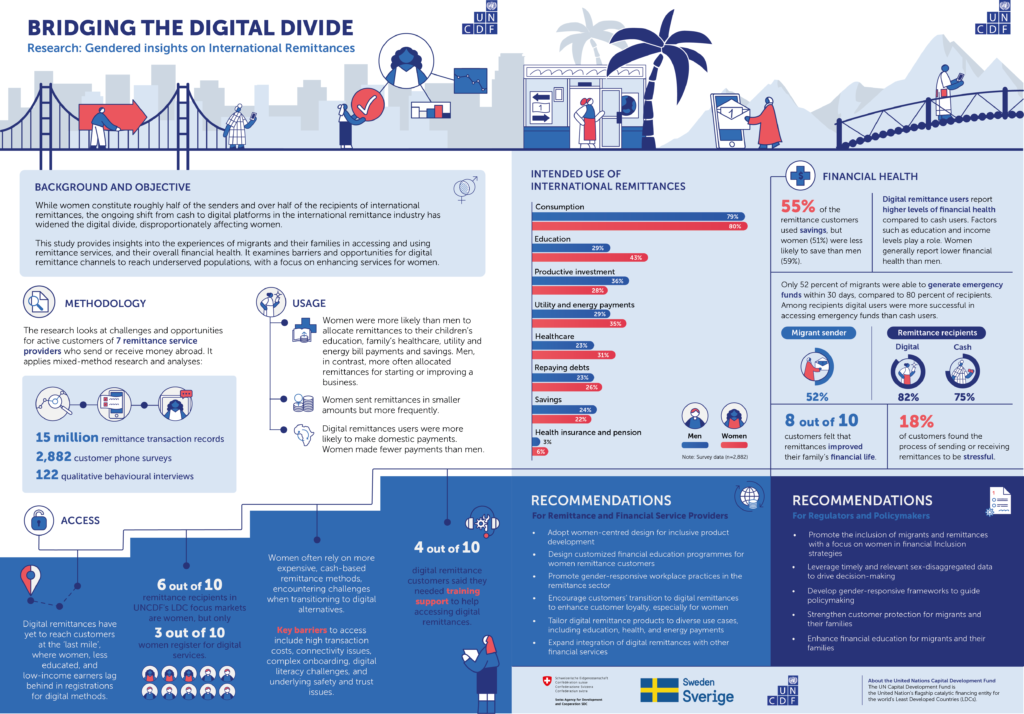

This report examines migrant and family experiences with international remittance services, focusing on digital channels and their impact on underserved populations, especially women. Conducted by the United Nations Capital Development Fund (UNCDF), this study involved seven remittance providers across Africa and Asia over the 2021–2022 period. A mixed method research approach was applied by analysing 15 million remittance transaction records, followed by 2,882 phone surveys and 122 qualitative behavioural interviews conducted with active customers of the remittance service providers (RSPs) who sent or received remittances. The findings reveal that digital remittances have yet to effectively reach underserved segments, particularly women, who face barriers to accessing and utilizing these services due to factors such as limited digital literacy, high transaction costs, overly complex onboarding processes, limited in-person customer service, inadequate tracking information, limited control over choosing the provider, and safety and trust issues in the use of services. The recipients and senders of remittances primarily used the funds for household expenses, followed by children’s education, utility and energy payments, medical bills, business expenses and savings. Gender-based disparities emerged as women prioritized family healthcare, education, and energy and utilities payments with smaller transactions, while men often directed funds toward larger business investments. Digital remittance users reported higher indices of financial health than cash users, although other socio-economic factors such as education and income levels also played a role. Notably, women generally reported lower financial health than men.

See related Articles and Case Studies:

- Shifting from cash to digital remittances during the pandemic: A case study of BRAC Bank in Bangladesh.

- Integrating remittance and mobile wallet services: A case study of IME Pay in Nepal.

- Accelerating the adoption of mobile wallets for remittances in Senegal: Insights from Wizall Money.

- Remittances and Financial Inclusion: Understanding the needs of migrants residing in South Korea, A case study of SentBe.

- Customizing Digital Remittances for Blue-collar Migrant Workers in the UAE: Harnessing the Power of Customer Archetypes, The Case of RAKBANK and Edenred.