Reference Guides

South-South Learnings on Analysing Remittance Data: Experience Across Central Banks in Latin America and the Caribbean (LAC)

The gaps between migrant financial preferences and policy and commercial interests result in market inefficiencies with social costs and underutilization of formal digital remittances, pushing migrants into informal, unregulated, and risky remittance channels. The UNCDF Migrant Money tools try to identify the constraints in existing market systems where low-income individuals operate and then attempt to address those constraints systemically. Facilitative in nature, they focus on leveraging the knowledge and existing capacity of the public- and private-sector stakeholders to deliver the desired path toward informed change.

Our toolkits provide a set of guidelines, reports, and tools packaged for application by public and private sector partners — which can be adopted, contextualized, and consumed — to help carry out the recommendations to move toward the desired state. The digital tools are platform-agnostic that can be readily adopted and customized by public and private sector partners according to their organizational and country contexts.

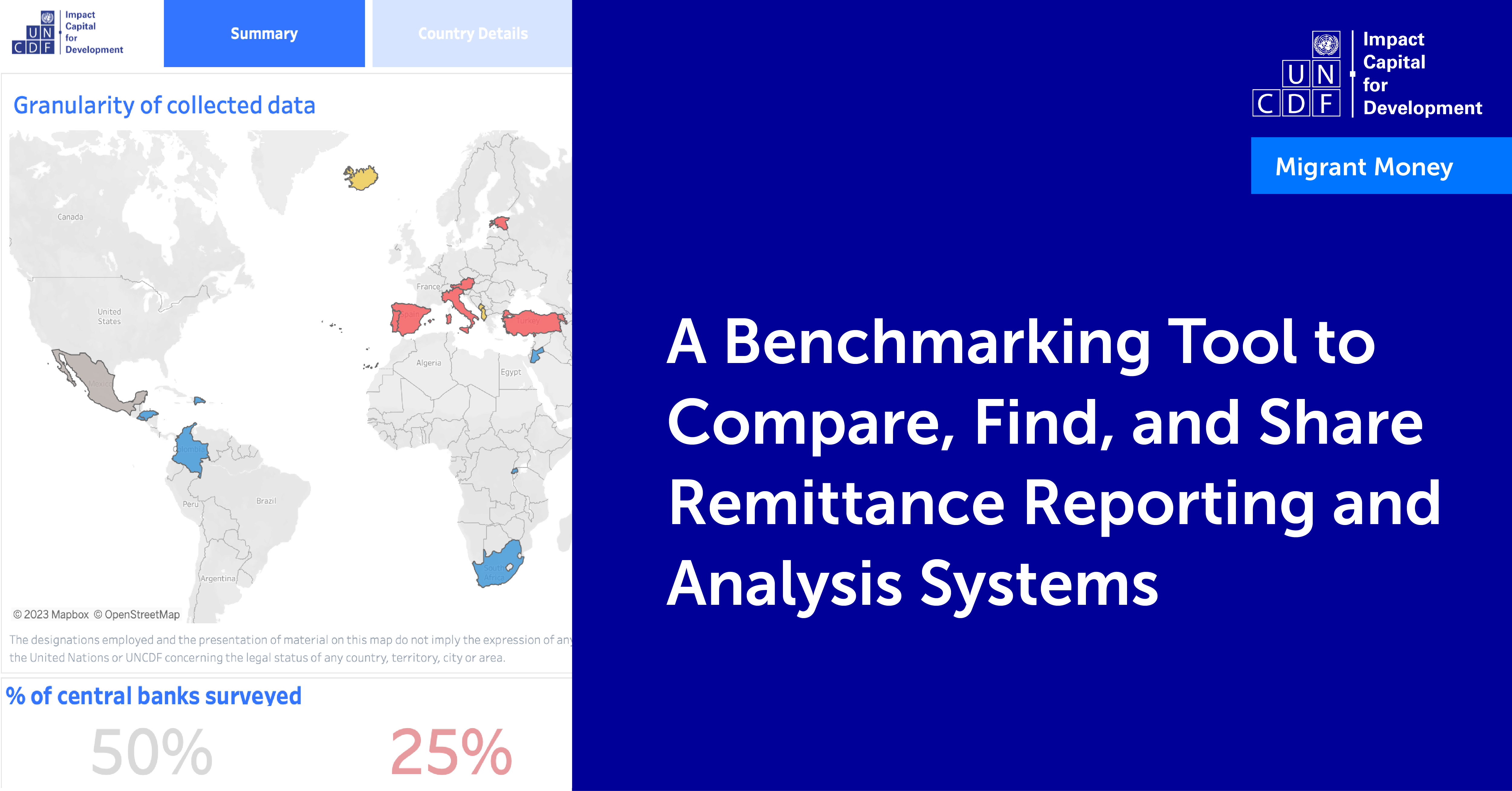

A Benchmarking Tool to Compare, Find, and Share Remittance Reporting and Analysis Systems

The UNCDF Remittance Reporting and Analysis Systems (RRAS) Benchmarking Tool compares countries’ access to detailed, timely, disaggregated data, legal mandate to collect data from providers on all cross-border transfers, data collection and management systems, cleaning and validation tools, external support and suppliers, and ability to generate insights from existing data using data analysis and visualization tools.

Human-centered Design for Migrant-centric Product Design Toolkit

This guide enables remittance and financial services providers to have an explicit and systematic focus on customer empowerment and gender by ensuring that a financial service or product is designed by balancing the needs of the user (desirability) with the technical possibilities of the RSP (feasibility) and the financial and strategic implications (viability). The human-centered design toolkit, specifically developed for migrant-centered financial services, consists of a website to support financial and remittance service providers in developing financial products and services tailored to the financial journey of migrant at a given time during the migration lifecycle: pre-departure, arrival, settlement, pre-return, post-return.

Migrant-centric and Gender-responsive Digital Financial Literacy Toolkit

This Digital Financial Literacy Toolkit was designed by UNCDF’s Migrant Money Programme for remittance and financial service providers offering financial services to migrants and their families to ensure that their customers are equip with the knowledge, skills, confidence and competencies to use their services. The first of its kind, the Toolkit serves as a guide to designing gender-responsive digital financial literacy programmes tailored to the need and context of remittance customers – both migrants and remittance recipients – as well as organizations in the remittance sector.

Accessible and Affordable Remittance Services for Refugees Toolkit

This toolkit has been created to guide those performing country assessments of remittance channels for refugees and forcibly displaced people. The guide contains practical tools for collecting data, identifying challenges, field research, and synthesizing data and recommendations. Implementing the toolkit will inform strategy development and approaches that humanitarian and development agencies may adopt to address constraints.

Our guides define a sequence of steps carried out at the beginning of an engagement to generate a baseline understanding of a particular entity or regulatory environment (company, country, region, laws, etc.) as it relates to remittances and the topic at hand, while also providing the basis for identifying the gaps or “recommendations” between the baseline and ideal state. These guides are open source, though designed for UNCDF as the primary users, and include tools and templates for the standardized assessment application.