Over the past two years, the United Nations Capital Development Fund (UNCDF) has partnered with remittance service providers (RSPs) to run innovation pilot projects. These projects aim to enhance migrants’ access to and usage of digital remittances to improve their overall financial inclusion and resilience. Based on the findings of these insights, several promising innovations are presently under development to improve women’s financial inclusion and increase their access to and use of digital remittance services.

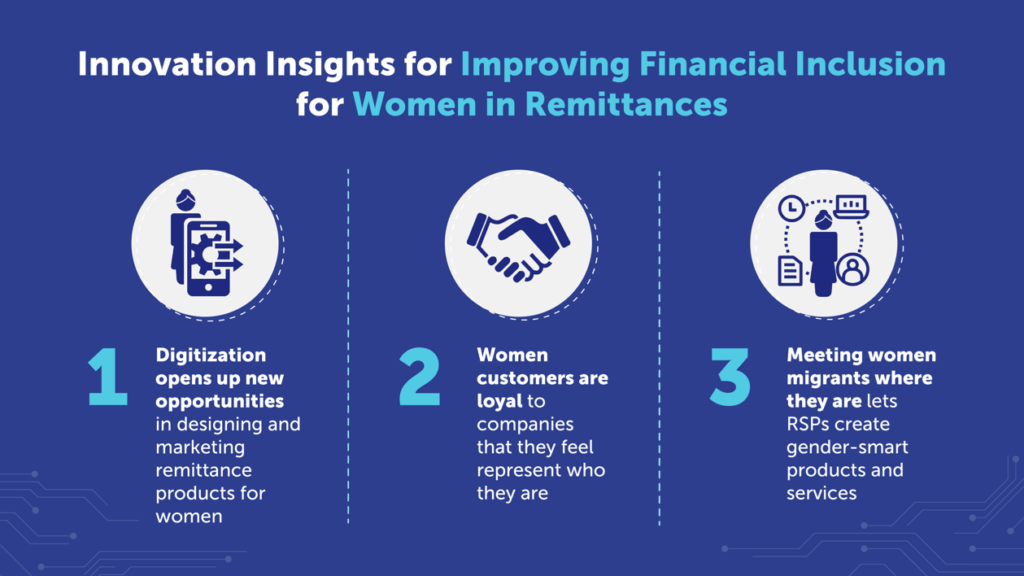

- Digitization opens new opportunities in designing and marketing remittance products that appeal to women and change how they engage with remittances. For example, BRAC Bank in Bangladesh has tweaked its mobile wallet interface to shorten transaction times, accommodate small transaction amounts and improve financial management. Consequently, the wallet now accounts for half of the bank’s inbound remittance transactions, and the share of women customers has steadily increased from 37 percent to 45 percent. Nepal’s IME Pay has merged its domestic wallet and international wallet to reduce entry hurdles, motivating more women to use the service. Wizall Money in Senegal is exploring a nano-loan product offering that can support women’s income generating activities and small businesses. Migrants in the United Kingdom can now use Ping Money to pay water and electricity bills for family members in the Gambia, a feature which has also proved to be a strong use case among women customers.

- Customers are loyal to companies that they feel represent who they are. As such, RSPs such as RAKBANK and Edenred in the United Arab Emirates are diversifying their workplace by hiring more women agents in the field and tele sales. Their initiative aims to attract more women customers who may not feel as able or comfortable interacting with men on financial matters.

- Meeting women migrants where they are lets RSPs create gender-smart products and services. Lucy has set up a targeted client outreach and awareness strategy in Singapore using social media platforms like Facebook and TikTok and advertising in places where domestic workers tend to go on their days off. Lucy has also translated its digital remittance service into Burmese, Tagalog, and Bahasa to add a more personal touch and encourage continued use of its digital remittance services. SentBe in Korea has introduced women-focused financial literacy programmes that have proved successful so far. SentBe has made brand awareness campaigns for these new demographics because many women who moved to Korea did so with marriage or student visas. Additionally, several other RSPs are looking into simplifying onboarding processes and requirements to make it easier for women to sign up for digital remittances because women often do not have the same access to identity and ownership documents as men.

Digitization, representation, and meeting customers where they are, are all ways to help women migrants get better access to financial services. The combined effect of each step makes the journey possible, which brings us to an important concept – innovations that improve financial inclusion for migrant women create a positive feedback cycle, indicating that once women gain access to formal remittances, they tend to include and support other women to do the same. We know that women migrants and remittance recipients tend to rely on women-based social networks to learn about and use digital remittance products and services. For this reason, each innovative step along the way, big or small, can catalyze meaningful financial inclusion and resilience for many more women. UNCDF is working with partners across Asia and Africa to mobilize this change.