Introduction

Approximately four percent of the global population, nearly half of whom are women, live and work outside their countries of origin. Remittances from these migrants represent a vital source of savings and supplementary income for millions of households in low- and middle-income countries. They are also pivotal for the family’s financial inclusion and resilience, debt burden reduction, income-generating activities, re-employment and business formation. Families often use remittances to mitigate risks. However, unforeseen events such as migrant death, illness or job loss impact the recipient family’s financial stability resulting in severe debt, inequality and poverty. Indeed, the risk of poverty for migrants is 1.5 times higher than for non-migrants. Similarly, the workplace mortality rate of migrants is at least 2.5 times that of their non-migrant counterparts.1

Insurance and pensions are essential safeguards for migrant families against unforeseen events because they mitigate the financial risks of death, disability, disasters, health issues, and poverty/low income in old age. The demand for such services has grown in the post-COVID-19 scenario, which highlighted the plight of migrants in accessing healthcare and repatriation services and a limited safety net of pension and old-age savings for migrants returning to their home countries due to pandemic-related job losses.

As highlighted in the UNCDF paper Scaling the Next Frontier in Migrant Money: The case of insurance and pensions, no more than three in every 100 migrants from low-income countries have access to portable social security schemes that could strengthen their financial resilience. Due to territorial boundaries and limited portability, migrant employment informality, and limited enforcement of migrant protection agreements in origin and destination countries, migrant insurance and pension services have remained an unmet demand despite being explicitly mentioned in five Sustainable Development Goals (SDGs) and several international conventions.

Building Blocks of Migrant Financial Resilience

Tax-funded non-contributory and co-contributory social protection schemes are fundamental building blocks contributing to the financial resilience of migrants and their families. In the paper Migrant Financial Resilience: Where are we in preparing the building blocks, UNCDF highlights bilateral, regional and multilateral agreements to provide social security coverage and benefits and the portability of social security entitlements to regular migrant workers. Beyond international conventions and guidelines, social security arrangements have also developed at the regional level, including in the European Union, ECOWAS, CARICOM, CAN and CIPRES countries. While only 30 percent of the bilateral agreements include migrant social security, governments in several countries, including Bangladesh, India, Jordan, Mexico, Pakistan, Sri Lanka, the Philippines, etc., have unilaterally introduced mandatory insurance or voluntary pensions for outgoing and incoming migrants.

Notwithstanding such efforts, the poor coverage of low-income migrants highlights the sub-optimal performance of public sector arrangements. Since major migrant corridors are still beyond the purview of such agreements, many of these schemes fail to deliver on the promise of financial resilience to low-income migrants, especially those in the informal sector.

Achieving migrant financial resilience may therefore require the public and private sectors to collaborate on a combination of tax-funded (non-contributory) social security systems complemented by contributory (partial or complete) market-based insurance and pensions. It will also require input from multiple specialists from the insurance and pensions ecosystems, namely regulators, policymakers, financial institutions, employers, and digital network providers.

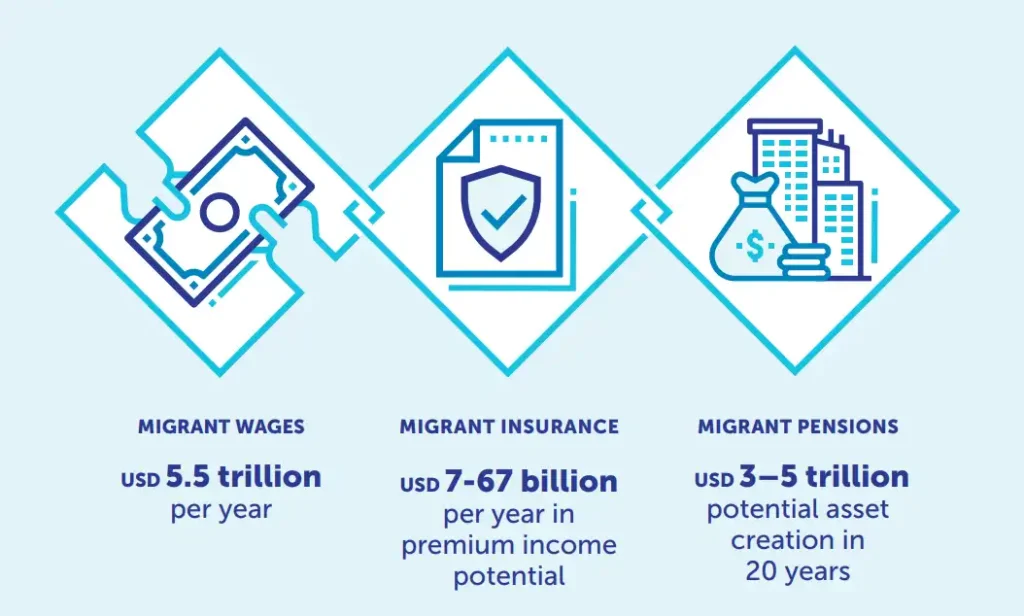

The unrealized potential of migrant insurance is to the tune of US$6-67 billion of premiums per year, while migrant pensions may generate assets of $3-5 trillion in 20 years. The private sector may find such business potentials lucrative enough to innovate across the migrant money ecosystem. Indeed, many innovations have flourished across different migrant corridors to deliver voluntary or co-contributory private sector insurance and pensions for migrants.

Challenges and the Path Ahead

As previously mentioned, a comprehensive migrant financial resilience ecosystem may necessitate that the social security schemes are complemented by contributory (or co-contributory) insurance and long-term pension systems for migrants. That said, the sector is still far from meeting its potential. While conservative legislation tied to territorial boundaries has restricted public sector initiatives, private sector initiatives are limited in their business model alignment throughout the insurance and pension value chain that could deliver scalable commercial ecosystems. Limited clarity in product design, distribution, and/or business strategies has also limited such schemes’ commercial viability and outreach. Nonetheless, there is still an opportunity for insurance and pension ecosystems to deliver migrant-centric and gender-responsive services in a scalable and commercially viable manner.

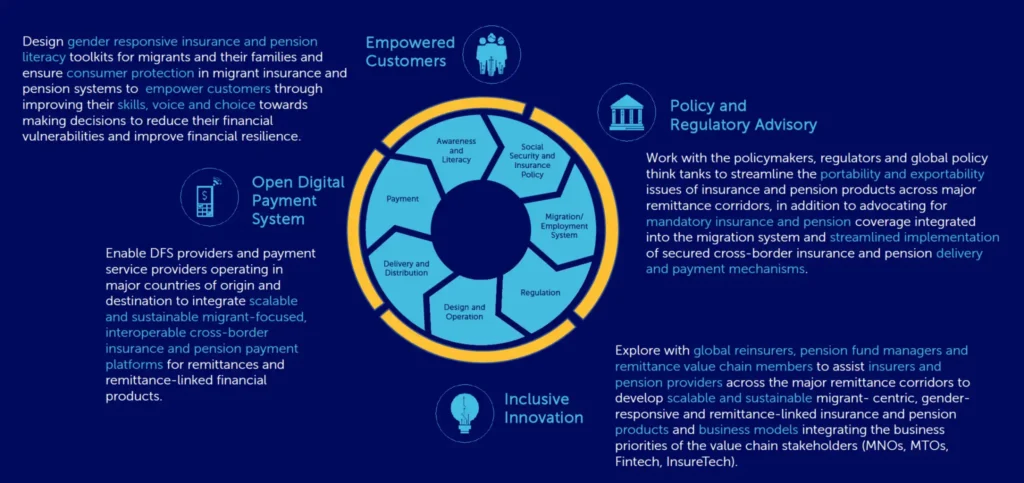

To identify strategic and tactical priorities for leveraging the potential of migrant insurance and pensions, UNCDF has consulted and pooled the perspectives of over 50 key stakeholders globally across the insurance, pension and digital finance ecosystems to chart a course for developing an ecosystem for the migrant community (See Figure 1).

Usage of digital financial services

In the paper “Migrant insurance and pension: Gazing through the future“, UNCDF proposes a set of priorities to achieve this ambitious agenda. The paper allots these priorities into four areas that must come together to create migrant-centric and gender-responsive financial resilience (insurance and pension) services for the migrants in a scalable and commercially viable manner.

- Enabling policy and regulatory environments at the national and international level

Bespoke legislation, regulations and supervision are at the core of migrant insurance and pension systems. Unilaterally or via bilateral/multilateral agreements, governments may introduce country- or corridor-specific mandatory insurance/pension policies for migrants and their families, which then become part of the migrant’s formal entry or departure from that country. Governments may also incentivize global interoperable market-based insurance and pensions in addition to ratifying social security conventions and creating a right-based policy paradigm for portable social security. This can be achieved by enabling payment regulations for premiums/contributions and claims, in addition to authorizing insurance/pension players to operate across borders to target migrant populations. Data-driven policies and favourable taxation regimes for migrant insurance and pensions are also crucial to realizing the sector’s full potential. Such initiatives will contribute to migrants’ financial resilience and comprehensive financial inclusion. At the same time, governments will boost their economy through insurance and pension penetration, institutional learning from international best practices, and increased attractiveness as a migrant-friendly economy. - Development of inclusive and innovative business models around the design, distribution and delivery of products and services

Market-based players must respond to technological innovation and shifting business value chains to realize the full potential of migrant insurance and pensions. In government-mandated co-contributory plans and voluntary migrant insurance/pension schemes, prioritizing migrants’ needs, gender, and digitalization in product design will ensure cost and service efficiency and foster healthier migrant-provider relationships. Consequently, there may be opportunities to scale up and simplify the market.

While traditional channels and processes must give way to new inclusive business models, harmonizing the business goals of all B2B and B2C partnerships (including with InsurTechs) that insurers and pension fund managers may deploy should remain a priority. Inclusive migrant insurance and pension business models must incorporate efficient cross-border processes for payments, contributions, underwriting, fund management and claims.Finally, behavioural nudges through claim and client literacy may be factored into the processes to ensure product uptake. - Improving cross-border open digital payment systems

Migrant insurance and pensions will need cost-efficient and interoperable payment channels to collect premiums and pension contributions between countries of origin and destination. These payment channels may also need to incorporate cross-border identification and electronic Know Your Customer (e-KYC)-based authentication services as migrants may be reluctant to use a separate payment platform for insurance and pensions. MTOs are uniquely positioned to provide these services because they process cross-border payments. - Empowering customers to boost their engagement and ensure that migrants receive high-quality products that are in their best interests

The gendered approach plays an essential role in developing insurance and pension products for women migrants, who often work in sectors that are informal in nature and different from their male counterparts. While collecting sex-disaggregated remittance data is essential to understanding women migrants’ needs, insurers and pension providers must also push the boundaries of gender-smart product design and deliver products through gender-sensitive channels.

Conclusion

The current state of migrant insurance and pensions, although sub-optimal, presents possible opportunities and prerequisites for a comprehensive financial resilience domain for the migrants. While the existing public and private sector initiatives need design, process and business modeling nudges, new innovations may flourish by leveraging emerging technologies and newer approaches blending insurance and pension products with remittance or other migrant-centric financial products. The success of both the existing and new innovations will, however, depend on the maturity and evolution of enabling regulatory, policy, and market environments in the origin and destination countries.

In the paper “Migrant insurance and pension: Gazing through the future“, UNCDF provides emerging narratives for designing and developing migrant insurance and pensions across the corridors. These narratives are built around a simplified qualitative design canvas, which may be a helpful and novel tool for assessing the suitability of any product or business design based on its dependence on regulatory and market system development across a migration and remittance corridor.

References

[1] Migration and the SDGs: Measuring Progress; IOM, 2022